By Moaaz Manzoor

The Pakistan Stock Exchange (PSX) ended the week on a strong note, with investor sentiment improving thanks to positive news about IMF inflows, a stable rupee, and easing geopolitical tensions.

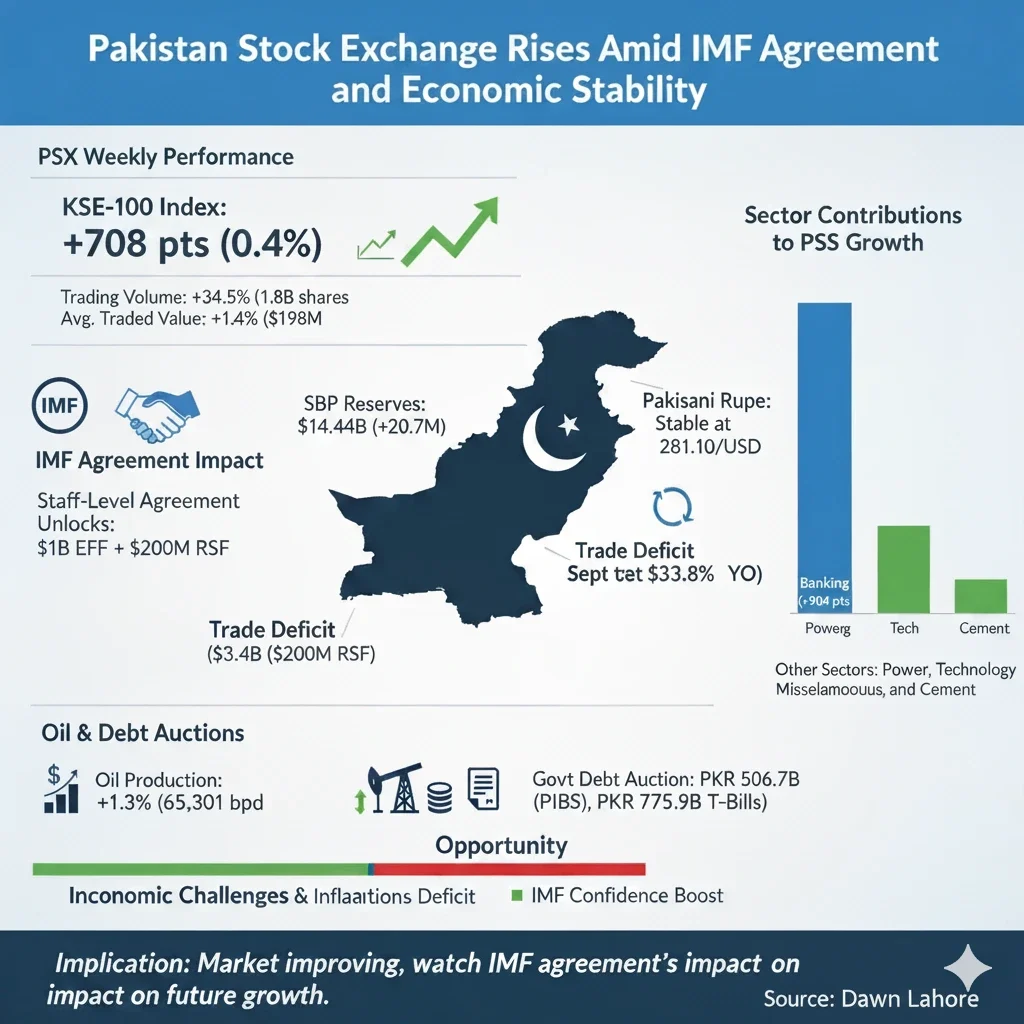

The benchmark KSE-100 Index closed at 163,806 points, gaining 708 points or 0.4% compared to last week, reflecting rising optimism about economic stability.

Trading volumes saw a significant increase, up 34.5% week-on-week to 1.8 billion shares. The average traded value also went up by 1.4%, reaching USD 198 million. This positive momentum was mainly driven by progress on Pakistan’s USD 7 billion Extended Fund Facility (EFF) and the USD 1.3 billion Resilience and Sustainability Facility (RSF).

Pakistan reached a Staff-Level Agreement (SLA) with the International Monetary Fund (IMF) this week. Once the agreement is approved by the IMF’s Executive Board, it will release USD 1 billion under the EFF and an additional USD 200 million under the RSF. This is expected to boost external financing and investor confidence.

Key Drivers of Positive Momentum in PSX

On the macroeconomic front, the State Bank of Pakistan’s (SBP) reserves rose slightly to USD 14.44 billion, up by USD 20.7 million from the previous week. The Pakistani rupee remained stable at 281.10 per US dollar, supported by steady remittance inflows and a decrease in import demand.

However, external accounts showed some strain. The Pakistan Bureau of Statistics (PBS) reported a trade deficit of USD 3.4 billion in September 2025, which widened by 33.8% compared to the same period last year, totaling USD 9.4 billion in the first quarter of FY26.

On a more positive note, refinery output excluding furnace oil increased by 21.6% year-on-year in September, reflecting stronger domestic economic activity.

Macroeconomic Trends and Their Impact on PSX

In the oil sector, production increased by 1.3% week-on-week, reaching 65,301 barrels per day, thanks to higher output from fields like Sharf, Pasakhi, and Makori East. The government also raised PKR 506.7 billion in the PIB auction, surpassing its PKR 450 billion target, and PKR 775.9 billion in the T-Bill auction, exceeding its PKR 750 billion target.

These figures indicate robust investor participation and stable yields in the debt market.

Sectors Driving Growth in the KSE-100 Index

According to Arif Habib Limited, the banking sector was the largest contributor to the KSE-100’s weekly gains, adding 904 points, followed by the power sector with 204 points, technology with 108 points, miscellaneous with 84 points, and cement with 69 points.

Top-performing stocks included UBL, HUBC, BOP, LUCK, and MEBL, while sectors like fertilizer, E&P, and OMC negatively impacted the index.

Outlook for Pakistan Stock Exchange After IMF Agreement

AKD Securities Limited noted that the market’s upward momentum was fueled by the IMF staff-level agreement, better credit outlook, and lower fixed-income yields.

The report also highlighted the KSE-100’s attractive valuation, noting a 7.3x earnings multiple and a 6.7% dividend yield.

Ali Najib, Deputy Head of Trading at Arif Habib Limited, commented that while the market saw periods of volatility, it stabilized towards the end of the week.

“Participants remained cautious due to ongoing inflationary pressures, and the upcoming monetary policy meeting is expected to maintain a status quo stance,” he said.

Syed Zafar Abbas, Manager at Zahid Latif Khan Securities, mentioned that the PSX remained volatile throughout the week.

“The index reached an all-time high of nearly 169,000 points before closing near 164,000,” he said, adding that the market seems to be entering a correction phase due to inflation concerns and border tensions. He also noted that a rate cut at this point would be surprising.

Author Profile

-

Moaaz Manzoor is a business correspondent who meticulously tracks Pakistan’s crucial but neglected natural resource industries.

He specializes in exposing inefficiencies and charting the course of modernization, highlighting how efforts to mechanize mining have dramatically cut marble and granite wastage, driving a recovery and attracting vital investment.